179 depreciation calculator

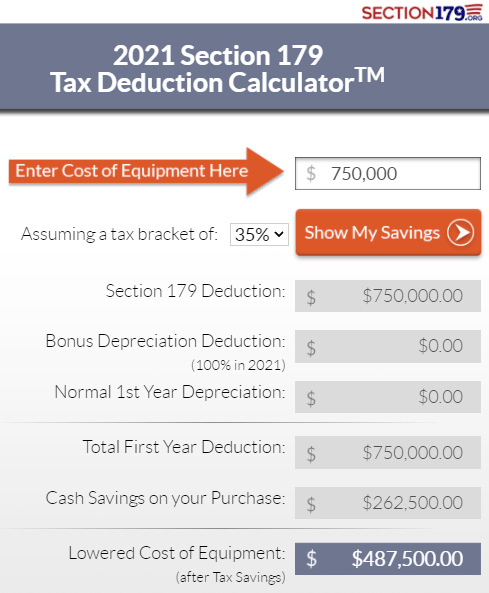

Using a 75000 equipment cost for a sample calculation shows how taking advantage of the Section 179 Deduction can significantly lower the true cost of the equipment purchased financed or leased. Section 179 deduction limit is now 1080000.

Macrs Depreciation Calculator With Formula Nerd Counter

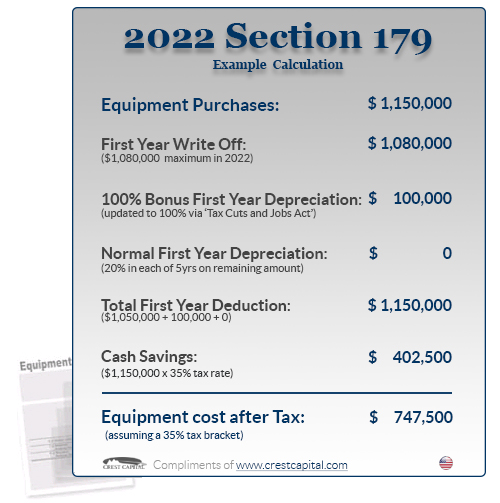

The total amount that can be written off in Year 2020 can not be more than 1040000.

. 1 in-depth understanding of the types and amounts of qualifying short-life assets 2 statistical. This limit is reduced by the amount by which the cost of. Most methods of depreciation allow you to deduct a portion of the equipments purchase price throughout its useful life.

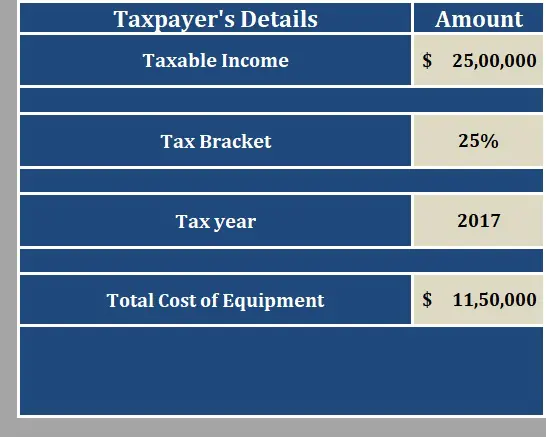

This means businesses can deduct the full cost of equipment from their 2019 taxes up. Section 179 of the IRS tax code gives businesses the opportunity to deduct the FULL purchase price of qualifying new and used equipment and software placed into service during the tax. Section 179 calculator for 2022.

Conceptually depreciation is the reduction in the value of an asset over time due to elements such as wear and tear. You can elect to recover all or part of the cost of certain qualifying property up to a limit by deducting it in the year you place the property in service. The vehicle must also be used for business at least 50 of the time and these depreciation limits are reduced by the corresponding of personal use if the vehicle is used for business.

Its fully updated for 2022 Section 179 limits and easy to use. Tax provisions accelerate depreciation on qualifying business equipment office furniture technology software and other business items. For 2021 Bonus Depreciation is 100.

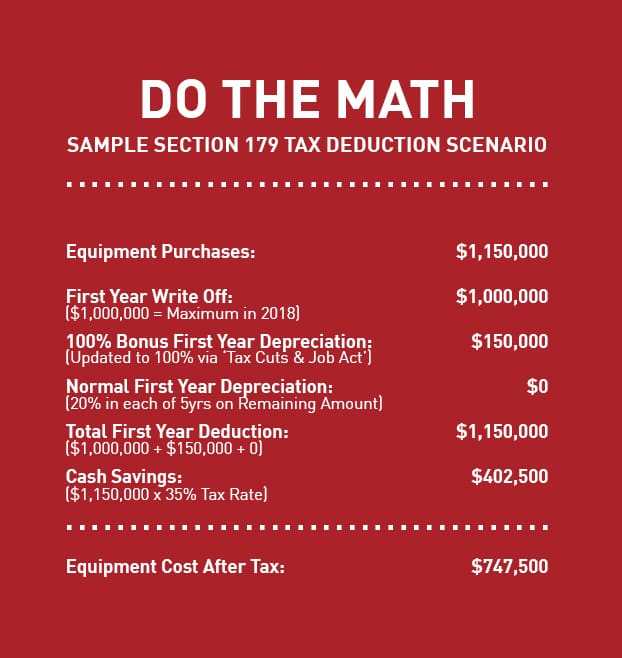

The Section 179 Deduction is now 1000000 for 2019. Limits of Section 179. For qualifying property you would still deduct just 1050000.

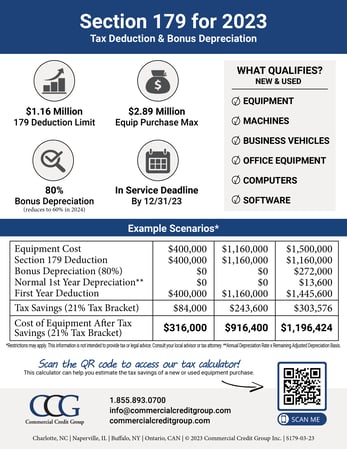

Section 179 Calculator for 2022. Under the Section 179 tax deduction you are able to deduct a maximum of 1080000 in fixed assets and equipment as a form of business expense. 2022 Section 179 Tax Deduction Calculator TM.

100 bonus depreciation for 2022 new and used equipment allowed. With a 1050000 deduction limit youll be able to deduct. Section 179 Deduction Calculator.

Section 179 Tax Deduction Limits for year 2019. 2022 Section 179 Deduction threshold for total amount of equipment that. But while Bonus Depreciation isnt technically part of Section 179 it can often be used as Part 2 of Section 179 savings.

Get an estimated tax write-off amount for qualifying Section 179 property that you purchase in 2022. Section 179 lowers the cost of your equipment by. There is also a limit to the total amount of the equipment purchased in one year ie.

Use Crest Capitals free Section 179 calculator to find out. The Section 179 Deduction and Bonus Depreciation apply for both new and used equipment. Section 179 does come with limits - there are caps to the total amount written off 1050000 for 2021 and limits to the total amount of the equipment purchased.

Section 179 can save your business money because it allows you to take up to a 1080000 deduction. The bonus depreciation calculator is proprietary software based on three primary components. Section 179 deduction dollar limits.

Enter an equipment cost. Use the Section 179 Deduction Calculator to help evaluate your potential tax savings. This is the section 179.

For instance a widget-making machine is said to depreciate. In our example 75000 in. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000.

Example Calculation Using the Section 179 Calculator. Section 179 of the IRS tax code gives businesses the opportunity to deduct the FULL purchase price of qualifying new and used equipment and software placed into service during the tax.

Section 179 Calculator Ccg

Section 179 Tax Deduction Calculator Internal Revenue Code Simplified

Section 179 Depreciation Tax Deduction 2016 2019 Taycor Financial 2016 02

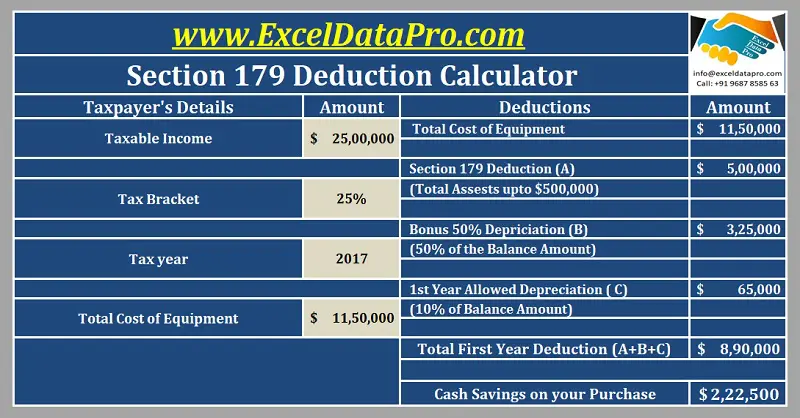

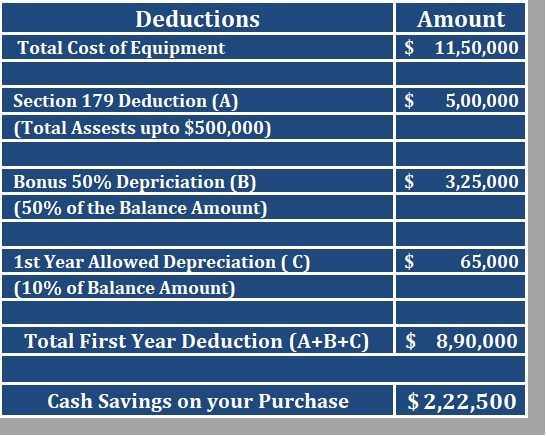

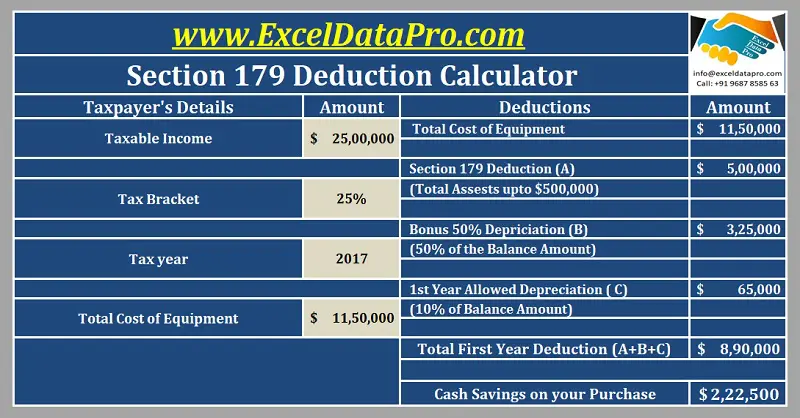

Download Section 179 Deduction Calculator Excel Template Exceldatapro

2021 Section 179 Deduction Calculator Guide For Equipment Equipment Radar

The Current State Of The Section 179 Tax Deduction

Free Section 179 Deduction Calculator For Us Internal Revenue Code

Download Section 179 Deduction Calculator Excel Template Exceldatapro

Macrs Depreciation Calculator With Formula Nerd Counter

Section 179 Calculator Ccg

Section 179 Deduction Hondru Ford Of Manheim

Download Section 179 Deduction Calculator Excel Template Exceldatapro

Ready To Use Section 179 Deduction Calculator 2021 Msofficegeek

Bellamy Strickland Commercial Truck Section 179 Deduction

Ready To Use Section 179 Deduction Calculator 2021 Msofficegeek

11 Common Questions Small Business Owners Ask About Section 179 Deductions In 2018 Custom Truck One Source

Ready To Use Section 179 Deduction Calculator 2021 Msofficegeek